The levy has dominated discussions in and out of Parliament with proponents stressing its importance to broadening the tax net while opponents have lamented its negative impact on financial inclusion and with respect to burdening small and medium-scale businesses.

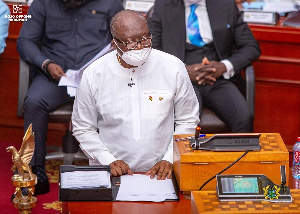

The Ministry of Finance has released some key components of the E-levy that are worthy of note. GhanaWeb publishes 10 of the ‘Frequently Asked Questions, FAQs’ released by the Ministry.

1. What is the E-Levy?

The E-levy is a new tax measure that will be applied only on the originator of a transaction on an electronic payment platform. These include fintech platforms, online banking andmobile money platforms.

2. What is the rate of the levy?

1.75%on the value of all applicable transactions.

3. How will the levy be applied?

The levy will be applied on the value (amount) of every transaction above GHS 100 on a daily basis. That is, after every GHS 100 (cumulative spend) the e-levy will be applied.

For example, if Kofi sends GHS 50 to his sister in the morning and sends another GHS 50 (GHS 100 in total) to his brother in the afternoon, he will not pay the E-levy. However, any other payment in the day after this threshold will attract the e-levy.

4. What transactions fall under the E-Levy?

The levy will cover the following;

• Mobile Money Transfers:sending money from your wallet to another person’s wallet or bank account using mobile money;

• Bank to Mobile Money Transfers: Transfers from a bank account to another person’s mobile money account

• Mobile Money Merchant Payments: when you pay for a service or a product from a merchant using your mobile money account;

• In-store Payments Using POS or QR: transactions at merchant locations that are done using a Debit/Credit Card, QR Code or alternative payment channel will be charged the levy;

• E-Commerce/Online Payments: E-LEVY will be charged to the customer for payments for goods and or services using Mobile Money, Debit/Credit Card, QR Code or alternative payment channel.

• Inward remittances: To be charged on the amount received by the individual from abroad

5. What transactions are not covered by the E-levy?

The following types of transactions exempt from the levy;

• Bank transfers and cheques – bank transfers and cheques from one bank account to another will be exempt from the E-levy

• Daily Free Limit – every person will be able to send up to GHS100 / day without payment of the levy

• Transfers between your own accounts – if you are moving money between your own accounts (i.e., of the same person) then you will not be charged the E-LEVY.

• Cash deposits into one’s personal mobile money account.

6. What will the revenue generated by the E-Levy be used for?

The monies will be used to support government initiatives such as youth employment and entrepreneurship, construction and maintenance of roads, digital infrastructure and security.

7. When will the E-levy come into effect?

The policy comes into effect from 1st January 2022.

8. Who will be collecting the E-Levy?

Government, through the Ghana Revenue Authority will collect the E-Levy in collaboration with the Telcos, Fintechs and Financial Institutions.

9. Why has GoG decided to levy electronic transactions?

• Our tax-per-GDP ratio is lower than our peers in West Africa and significantly lower than many developed nations. (South Africa- 26.7%, Senegal- 16.4%, SSA average-16.5%, Ghana-12.2% in 2019)

• E-levy provides an opportunity for every Ghanaian to contribute towards nation building

10. Has this been done in any other country?

Yes. So far, 26 countries have proposed/enacted the legislation for digital taxes. (Source: KPMG, Taxation of a digitalised economy (as at 28th September 2021)

These countries include; Kenya, Nigeria, South Africa, Egypt, Tanzania, Mauritius, Uganda, Cameroon, and Zimbabwe.

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More