Seven million Ghanaians earn below GH¢7,000 annually, Finance Minister, Ken Ofori-Atta has revealed.

According to him, 83.6% of Ghanaians also do not have real savings and are vulnerable to economic hardships in the event of crises such as the COVID-19 pandemic.

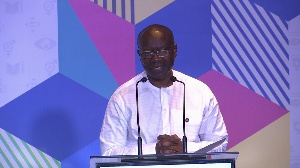

“In Ghana, it is more devastating because when we look at the numbers for savings, 83.6% of our people do not have real savings in the event like this. We also have a situation where you have the 15 to 34 age group, in terms of economic earning potential, about 59% of them are in this category, whereas 39% are between 35 and 64. So, that create a million people that can easily been thrown out, and more significantly about seven million of our people earn below GH¢7,000 a year, so, we need to look at that”, he disclosed at the launch of the GHS600 million COVID-19 Alleviation Programme which would be administered by the National Board for Small Scale Industries (NBSSI).

“When you look at business establishments, we have, under the medium scale enterprises, 1.46%; the small businesses being 18.3% and the micro being 79.7%. So, it’s imperative that we intervene and intervening as per the directive of the President.”

Additionally, Mr Ken Ofori-Atta said his outfit has also established a task force to further work on the recovery, stabilisation and revitalisation programme which will concentrate on industry and manufacturing to spur growth and minimise job losses, as well as to ensure that the post-COVID-19 recovery is at a faster pace.

Due to this, the government is setting up a Development Bank of Ghana to become a critical part of the post-COVID-19 strategy in rapid industrialisation and agricultural modernisation to turn Ghana into a regional hub.

The NBSSI had earlier said it is conducting a stress-test on the efficacy of its application portal before it launched the GHS600 million stimulus package for Micro, Small & Medium Enterprises.

It will, however, accept manual applications in the districts so that it does not exclude SMEs in the districts from accessing the facility.

The soft loan scheme will have a one-year moratorium and two-year repayment period.

Source: Class FM

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More