The Securities and Exchange Commission (SEC) will begin accepting relevant documents for the validation of investment claims on November 18, 2019, following the revocation of the licenses of 53 Fund Management Companies.

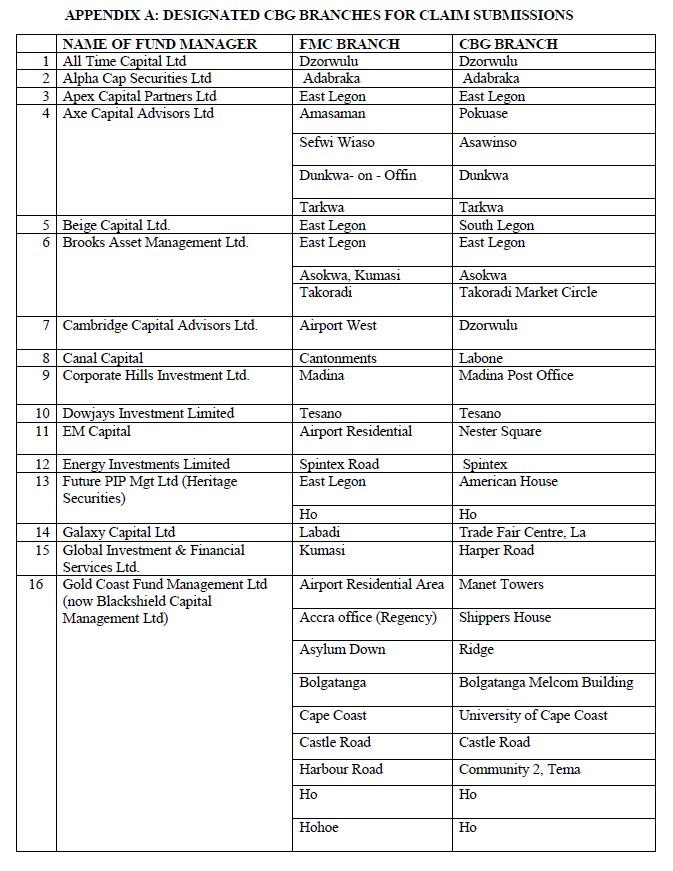

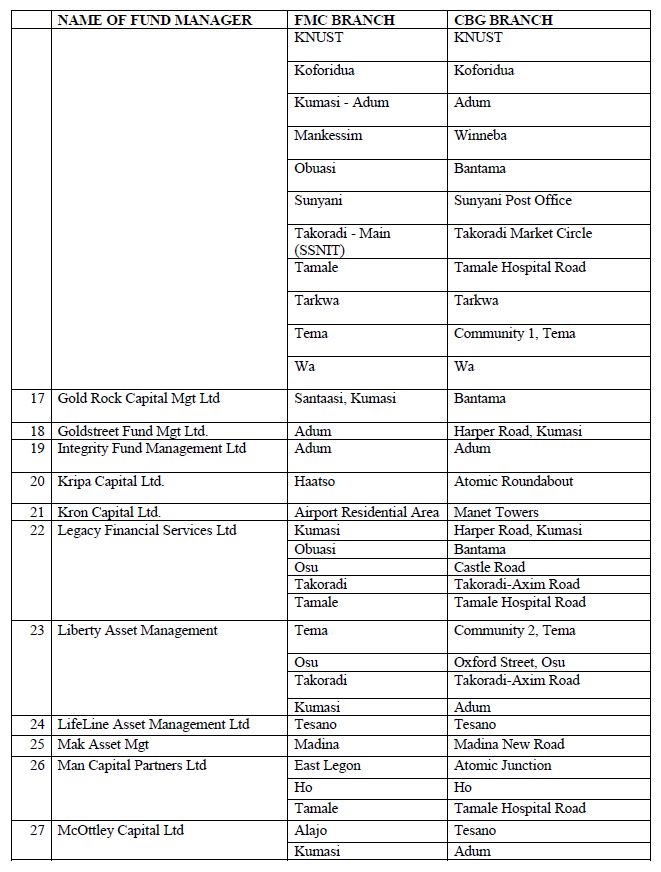

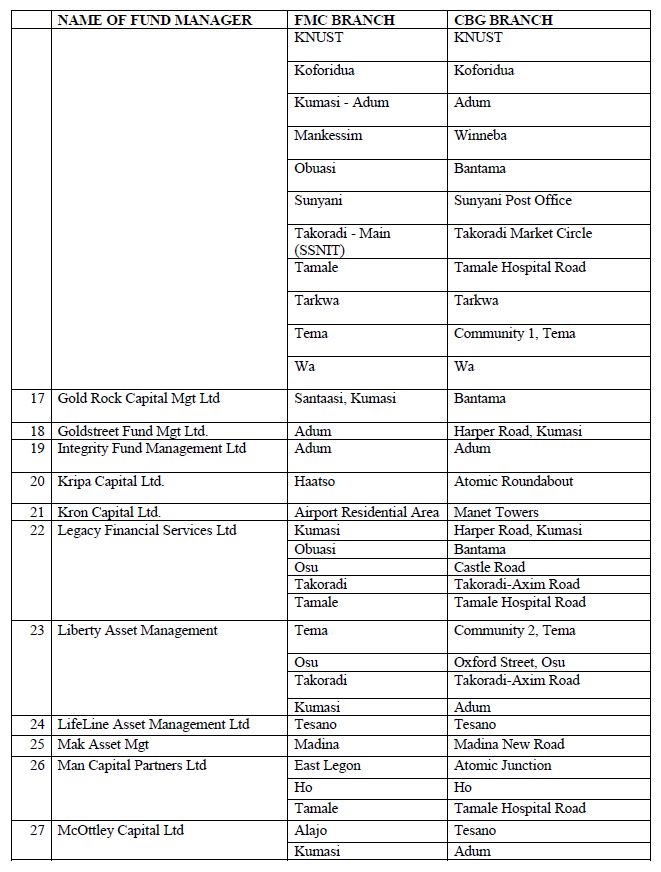

In a statement, the SEC said designated branches of Consolidated Bank of Ghana Limited (CBG) will open to receive the claims from clients who have their funds locked up at the affected companies.

The SEC said it has authorised the said branches serving as agents “to ascertain and validate details of investors and their investments with these institutions at the time of the revocation to facilitate the administration of the Government pay-out of a capped amount to affected investors.”

The agent is also to support in “the closing down, securing the premises and records of these [collapsed] institutions.”

The SEC is expecting evidence of investment claims such as investment certificates, account statements, receipts among other relevant documentation for validation.

“Investors are advised to visit the designated CBG branches assigned to the affected FMCs for repayment of investments made and any other enquiries relating to the revocation of their affected FMCs.”

Over GHc8 billion locked up

The 53 fund management companies that had their licenses revoked were managing customers’ funds which run in excess of GHc8 billion, according to Citi Business News’ sources.

The source claimed the affected companies were managing funds belonging to some 56,000 customers, who are expected to take part in the validation process.

The SEC took its action in line with Section 122 (2) (b) of the Securities Industry Act, 2019 (Act 929), adding to the clean up of the financial sector.

It said the companies largely failed to return client funds which remain locked up and in a number of cases, the firms had even folded up their operations.

The SEC said the affected firms essentially have failed to perform their functions efficiently, honestly and fairly and in some cases are in continuing breach of the requirements under relevant securities laws.

Unlike the banking sector reforms where a receiver was immediately appointed to take over collapsed banks, the capital market regulations stipulate that the resolution of these fund managers must be done through an official liquidator which will be appointed by a High Court working through the Registrar-General.

Find below the selected branches

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More