An audit into the state of the Confederation of African Football (Caf) has revealed an organisation in a state of disarray – both with regard to finances and governance.

Carried out by Pricewaterhouse Cooper, the audit describes Caf’s accounting as ‘unreliable and not trustworthy’ as it highlights transactions totalling in excess of $20m which either have ‘little or no supporting documentation’ or are considered ‘higher risk.’

One area it suggests further investigating is ‘the role played’ by Caf President Ahmad and his attaché Loic Gerand, among others, in the deal with French company Tactical Steel – some of whose financial dealings with Caf are described as ‘highly suspicious’.

Ahmad has already strenuously denied any wrongdoing with regard to this case.

The forensic audit – which was complicated by Caf’s tendency to make most of its payments in cash – also suggested considerable reforms were needed throughout Caf.

The organisation’s structure is described as being over-reliant on decisions made by the Executive Committee (ExCo), despite the latter meeting ‘once a quarter, resulting in delays in key decision-making and preventing managers of Caf departments from making timely business-critical decisions’.

In addition, a lack of clarity in Caf’s organisational structure has left departments ‘understaffed’ and existing staff both ‘overworked’ and ‘generally demotivated’.

The confidential audit, a copy of which has been seen by the BBC, was carried out as part of the unprecedented decision to send Fifa’s Secretary-General to improve the governance of African football’s ruling body.

Fatma Samoura concluded her six-month role in early February, whereupon she presented her findings to leading figures in the Caf administration, who have said they will address the recommendations laid out by a joint Fifa/Caf taskforce.

These include, among others, a major restructuring of Caf’s organisational hierarchy, introducing a term limit for both the President and ExCo members and the introduction of an ethics code.

Whether ExCo members, who determine their own salaries and bonuses according to an audit which suggests amending this, are prepared to approve fundamental changes when they meet on Friday is another matter.

“More than 30 years of an outdated and patriarchal management at Caf have resulted in important shortcomings at all levels of operations,” Caf said in a statement earlier this week.

“Caf will persevere … to ensure that we achieve the highest international standards.”

The damning audit highlights a raft of financial deals which require further investigation, with Caf President Ahmad, a 60-year-old from Madagascar, one of those under scrutiny.

The president

Image captionAhmad has been President of Caf since March 2017

- ‘From the email communication, it appears that Tactical Steel established the initial contact with Caf through Caf’s President office’

PwC wants an investigation into Ahmad’s role in the controversial decision to employ a little-known gym equipment manufacturer to become a key supplier of sportswear to Caf.

Ahmad has previously told the BBC – in response to being asked if he had cancelled a deal with sportswear company Puma (value: $248,055) to take up a larger order with Tactical Steel (value: $1,015,313) in December 2017 – that the accusations were ‘false, malicious, defamatory (and) part of a vendetta’.

This was an accusation levelled at his former General Secretary, Amr Fahmy, who had formally complained to Fifa – as did Caf’s former Finance Director Mohamed El Sherei – with both men having since been relieved of their posts. (The audit recommends assessing both the roles of Fahmy and Caf’s finance department regarding Tactical Steel.)

“From the communications reviewed, it appears that Caf’s President office was directly involved in agreeing to the initial offer of Tactical Steel and then the additional handling and logistics costs without involving relevant departments in Caf such as Procurement, Marketing and Finance,” states PwC.

Tactical Steel is run by Romauld Seillier, a long-standing friend – and former army colleague – of Loic Gerand, Ahmad’s attaché.

Image captionTactical Steel’s website highlights its role in both making and supplying gym equipment

During the course of this deal – which was to provide sportswear and footballs, among other items – several payments made by Caf to Tactical Steel and the latter’s affiliate ES Pro Consulting Ltd, based in the United Arab Emirates, were returned to Caf for reasons that are unclear.

“The refunds from Tactical Steel and ES Pro Consulting … are highly suspicious which could potentially indicate a kickback arrangement between parties involved or a case of tax evasion through off-shore payments,” ventured the audit.

In June 2019, Ahmad – who took charge of Caf in March 2017 – was questioned in the French capital Paris by anti-corruption authorities before being released without charge.

PwC’s audit has also suggested closing down Caf’s Emergency Committee, a group involving the Caf President and any three ExCo members which can bypass ExCo and fast track decision-making.

“Based on the documentation at hand, it appears that the decisions of the Emergency Committee has (sic) been taken in a less than transparent matter,” the report stated.

The audit says it observed ‘multiple payments for the same period/dates’ when it came to claiming travel expenses – and although it failed to mention Ahmad by name, the BBC reported last year on how the Caf President received two different sets of expenses when claiming to be in two different countries at the same time.

Given that the audit was conducted ‘in relation to Fifa Ethics guidance’, it remains to be seen what action – if any – will be taken against the Malagasy.

‘Unusual payments’

Image caption The Confederation of African Football’s headquarters in Egypt

- ‘A large number of payments were made in cash. The use of cash for business expenses in this manner results in little or no audit trail to verify if the cash has been spent legitimately or not’

As part of its audit, PwC reviewed just under $10m of payments made with money that Fifa gave to Caf to distribute as part of its Fifa Forward programme, which aims to enhance football development in countries across the world.

However, only 5 of the 40 payments “appeared to be aligned to purpose,” said the report.

The rest – totalling some $8.3m – either had ‘little or no supporting documentation’ or were considered ‘unusual/higher risk’ with no patterns ‘identified in terms of the nature or the value of the payments’.

Details were thin on the ground in some cases – with the central and East African region Cecafa receiving a payment of $500,125 when the only information given was that this was to organise an Under-17 match in Burundi.

Meanwhile, southern African region Cosafa was allocated $412,246 to stage an Under-20 game.

The story was largely the same for the annual subvention funds that Caf pays to its 54 member associations, which is currently $200,000 per year – having risen from $50,000 and then $100,000 per year under Ahmad.

Of the 66 high-risk payments reviewed, 48 – worth some $11m – had insufficient documentation.

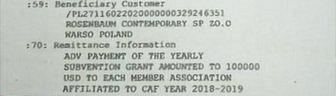

Particularly troubling were three payments of $100,125 each supposedly made for the benefit of the Liberian FA – one of which ended up in Estonia, two of which were sent to a mystery company in Poland.

Image caption An annual grant supposedly destined for the Liberian FA ended up in a company in Poland

This was called Rosenbaum Contemporary and when its website was operating – prior to disappearing in 2019 – it identified itself as an industrial company.

Why the money went there is unclear, with PwC recommending legal action to recover the funds as well as a desire to ‘rule out “insider” involvement’ within Caf.

Complicating matters for those trying to understand the true nature of Caf’s finances is the fact that many of the organisation’s payments are made in cash, particularly to staff.

It cites a withdrawal of $350,000 in cash in December 2017, which was simply marked as ‘payroll expenses’, by way of example.

Of the 25 information requests that PwC made to Caf, all were granted save for three – with both ‘bonuses’ and ‘travel expenses’ among the latter.

Executive committee

Image caption Executive Committee members are said to hinder, not help, Caf’s operations

- ‘During the review, it was observed that payments and reimbursements to ExCo members majorly contribute to Caf’s administrative expenses’

Caf’s ExCo – which is effectively the organisation’s board – also has issues to address in light of the audit, which questions the manner in which they are compensated.

“Exco members – jointly or through a committee comprising a part of the Exco members (e.g. compensation committee) – propose and approve salaries, bonuses, end of term benefits, indemnities and allowances for the members of the ExCo, leading to a self-approval situation.”

Thirty-five payments made to the ExCo were reviewed yet not one had all the ‘required documentation to clearly establish the legitimacy of the payments.’

In 2016 – a period when Ahmad’s predecessor Issa Hayatou was in charge – $36,150 was paid to wives of ExCo members yet the latter could not provide documents re the ‘eligibility of spouses of ExCo members for such payments’.

“Caf has also booked several ad-hoc payments to ExCo members – e.g. buying gifts, offering donations, organising funeral etc. – for which no documents were provided for review,” the audit added.

Despite receiving indemnities of $450 per day when on duty and an annual bonus of at least $60,000, ExCo members are considered by the audit to hinder Caf’s daily working activities.

“The ExCo, which is held responsible to take all executive decisions, meets once a quarter, resulting in delays in key decision-making and preventing managers of Caf departments from making timely business-critical decisions.”

Governance

Image caption Despite the issues, Caf hosted a glittering awards ceremony in Egypt earlier this year

- ‘Caf being a football governing body to promote and develop the game in Africa, it is important that Caf effectively manages its stakeholders – external and internal – effectively. Currently, there is little or no understanding about who the stakeholders are for the individual department’

With an unclear hierarchy and delays in decisions, Caf’s working environment appears far from perfect – with the result that staff are said to be ‘demotivated’.

“Staff expressed a lack of systematic communication, concerning key decisions, resulting in a great amount of unclarity … and feeling of exclusion,” said the audit.

“Staff are unaware of the existing organisation structure… Job roles and responsibilities assigned to individual staff members are not properly defined and known.”

The list goes on – from a lack of leadership, committees meeting on an ‘ad-hoc basis without systematic planning’ through to the lack of a dedicated IT department.

In addition, staff attendance, overtime, vacations and medical absences are said to be neither monitored nor captured.

Meanwhile, large swathes of financial records are simply missing – with PwC estimating that it was unable to access around 20% of the data required for the period in review, which covered 2014-2019.

“Several sweeping governance and operational measures have already been implemented before and during the six-month partnership with Fifa,” Caf’s statement said.

“The ExCo has scheduled a meeting for 14 February to validate the 2020-21 Caf roadmap which will take into accounts (sic) all the recommendations.”

Given the roadmap suggests relieving the ExCo of management and administrative responsibilities, it promises to be quite some journey.

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More