It is recalled that Dr Kwabena Dufour’s UniBank made an announcement on 7th March, 2018 to the effect that a consortium of financial institutions had pledged their shares, proceeds, entitlements and voting rights to UniBank to make it the majority shareholder in ADB. These financial institutions included: Belstar Capital, a turnkey project finance implementation institution, Starmount Development Company Limited, EDC Investments Limited and SIC-Financial Services.

Interestingly, in just a few hours, on the same day, Wednesday 7, 2018, the Bank of Ghana, in a rather swift response to this announcement, denounced as null and void, the purported takeover of ADB. The BoG further explained that the decision by these shareholders leading to the alleged takeover was not sanctioned by the BoG, therefore, the takeover was null and void.

On the 20th, same month of March in 2018, the BoG in a press release announced the takeover of UniBank and immediately appointed KPMG as the official administrator of the Bank. The regulator quoted sections 107 and 108 of the Banks and Specialized Deposit-Taking Institutions Act, 2016 (Act 930) to back its decision.

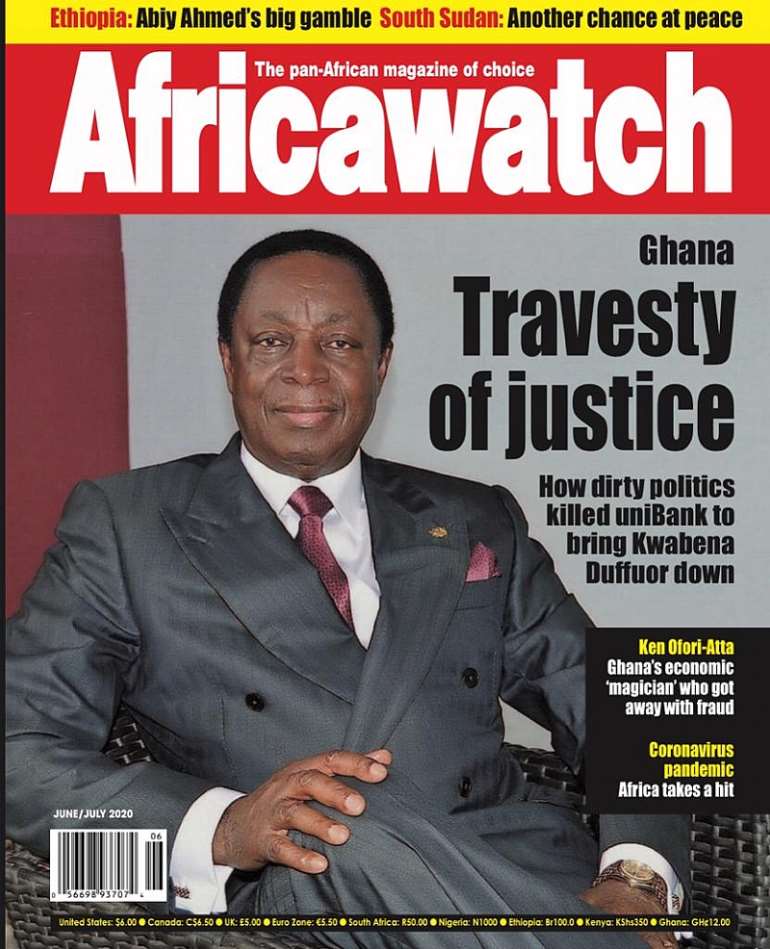

In its June/July 2020 Edition, the AfricaWatch Magazine has done a comprehensive special report on UniBank and its takeover by the BoG. The international Magazine notes among others that UniBank was deliberately destroyed on political grounds, knowing that Dr Kwabena Dufour, an NDC member, needed to be brought down.

The report claims that Ken Ofori-Atta, Ghana’s Minister of Finance and cousin of President Akufo-Addo, Dr Ernest Addison, Governor of BoG and Nii Amanor Dodoo, the appointed Administrator on behalf of the receiver (KPMG), colluded to collapse one of Ghana’s successful indigenous banks (UniBank).

The report also notes among others, the coordinated decisions from the Ministry of Finance to BoG and finally the Receiver, KPMG to get what it describes as political deal executed according to plan. All of these decisions meant to frustrate the board of directors and shareholders of UniBank.

For instance, it says that the BoG acted against the rule of thumb in Ghana’s banking industry by singling out UniBank to carry out unannounced and unplanned monthly audit. Meanwhile the law allows the BoG to carry out planned auditing of banks once every year, a duty the central had a timetable for and judiciously carried out for years.

The Magazine says it stumbled upon audit reports that revealed that between May and October 2017, the BoG through its Banking Supervision Department sent four audit teams to UniBank, three of these visits were unannounced.

They teams in turns audited and downgraded UniBank’s loan books, making its Capital Adequacy Ratio worse.

Curiously, the fourth audit team downgraded even the government and its agencies indebtedness to UniBank. This gave the impression that government cannot be trusted and not solvent enough to pay its debts to UniBank.

Ghana Government and its allied agencies indebtedness to UniBank amounted to about GHC 1 billion, an amount when paid to the bank will raise its Capital Adequacy Ratio, therefore making its solvent to escape the BoG hunting.

Note: The following government institutions owe UniBank the attached respective amounts:

Cocobod…GHC 137,499,785.98,

Ministry of Finance…GHC 223,049,720,

Road Fund…GHC 229,434,748.82,

GETfund…GHC 2,023,981.10,

Bank of Ghana…GHC 19,781,376.00,

BOST…GHC 105,741,493.33,

Qausi-government entities…GHC 98,553,636.86 and

Other government contractors…GHC 52,889,558.49.

A total of about GHC 868.974m, which is two times the required amount UniBank needed to recapitalize.

So, if the government and its quasi-bodies had paid their indebtedness to UniBank, the bank would have not needed any capital injection from the BoG to remain solvent, the report said.

The Magazine noted the decision by the BoG to swiftly announce the takeover of UniBank due to its insolvency when the BoG itself owes the bank a whopping GHC 19,781,376.00 is curious if not ironical.

It claims that is why the BoG and its appointing authorities would not take the request made by UniBank to pay its indebtedness and make it stronger because the decision to bring Dr. Dufour down was planned.

Source: Africawatch

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More