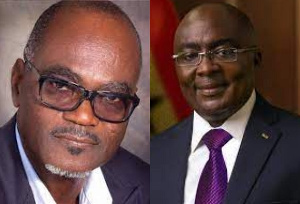

Business magnate and economist, Dr Kofi Amoah, has said there are serious considerations to make if Ghana is to embark and fully implement its new policy of paying for oil and other essential imports with gold instead of US Dollars.

The vice president, Dr Bawumia, recently announced the policy, claiming it is the best way to deal with the dwindling foreign currency reserves and the insatiable demand for dollars by oil importers which is weakening the local cedi and increasing living costs.

“If implemented as planned for the first quarter of 2023, the new policy “will fundamentally change our balance of payments and significantly reduce the persistent depreciation of our currency,” Bawumia said.

According to Dr Amoah, while he is not against Ghana finding its own way and methods to deal with its impending financial crises, but cautions “let’s pick our fights carefully.”

Dr Amoah opines that the move could be interpreted as trying to “disgorge the USD as the major international currency for payment.”

In an interview with GhanaWeb, Dr Amoah who has previously campaigned for Ghana to stop its excessive borrowing said broader consultations should be had with countries like China and Russia if this move is to see the light of day.

Read below Dr Amoah’s concerns with the new policy

Ghana has announced making international payments in gold instead of USD

First let’s find out how MUCH REFINED GOLD DEPOSIT Ghana really has, and if it’s not already mortgaged as collateral.

Let’s also see how many countries, banks or other international institutions will accept gold from Ghana for payment without first exchanging the gold into USD.

Is Ghana ready or capable to contest the US in any efforts seen as attempts to disgorge the USD as the major international currency for payment, not gold.

Has China been consulted privately/confidentially for engagement? International currency for commercial transactions is a major source of global power, probably second only to the possession of nuclear arsenals.

I’m not against efforts to creatively solve our impending financial crises, almost existential, but let’s pick our fights carefully.

Putin could demand payment for its oil/gas in rubles (when the value was being crushed by Western sanctions) because Russia had short-term monopolistic market position of its gas to Germany and other European countries, and Putin could justify it was in direct retaliation of the West’s efforts to undermine its economy.

There are other equally cogent methods for getting Ghana out of the hole but the President refuses to entertain such ideas from ‘some’ citizens even after several written requests.

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More