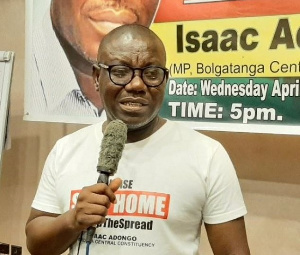

Finance firms owned by Finance Minister Ken Ofori Atta and Minister of State at the Finance Ministry Charles Adu Boahen have been named transaction advisors to the Finance Ministry, Bolgatanga lawmaker Isaac Adongo has said.

According to him, Black Star Brokerage owned by the Minister of State and Databank founded by the Finance Minister have been named among the three primary dealers selected by the ministry.

“The Ministry of Finance headed by Messers Ken Ofori-Atta and Charles Adu Boahen just announced a list of primary dealers and introduced a new term called Bond Market Specialists. Interestingly, firms owned by these two personalities, Databank owned by Ken Ofori Atta and Blackstar Brokerage Limited owned by Charles Adu Boahen have been selected as two of the three local investment advisory firms,” the lawmaker wrote in a statement.

He said the two public officials are caught in a conflict of interest situation.

“This is a clear conflict of interest. The Minister for Finance has made government borrowing his private business and benefitting each time Government borrows through Databank either as a bookrunner or Co-Manager of Eurobond issuance”.

He said their position makes it difficult to appreciate objectively the reasons behind government’s increased borrowing.

In December 2020, the finance Ministry advertised for interested firms to apply to be entr for transaction advisors for the ministry.

Below are details of the request placed by the ministry

BACKGROUND

The Government of the Republic of Ghana intends to launch a 2021 International Capital Market (ICM) funding programme for the medium term. For the 2021 portion of the programme, the Government intends to raise up to US$ 5.0 billion to support growth-oriented expenditures in the 2021 Budget, conduct liability management including refinancing domestic debt and a buyback of some selected outstanding Eurobonds.

INSTRUMENTS UNDER THE 2021 INTERNATIONAL CAPITAL MARKET PROGRAMME

The instruments for the programme consists of the following broad group of instruments:

Eurobonds;

Diaspora Bonds;

Sustainable Bonds (Green Bonds and Social Bonds); and Syndicated Term Loans

All applicants must separately indicate their willingness (in writing) to provide bridge financing if needed and the quantum, terms and timing thereof.

SCOPE OF WORK

The selected Transaction Advisors (Lead Manager and Co-Manager) for each instrument shall be required to provide but not limited to the following services:

advising, guiding and driving the international capital market funding program process;structuring and documentation of the program;

work with other professionals including Legal Counsel and Local Advisors to assist in the execution of the program where necessary;

market sounding through roadshows etc. and engaging with institutional investors and lenders;

participate in the bridge finncing if needed;

ensuring the financial close of the program; and

any related assignment principal to the success of the programme The aforementioned tasks are intended only as a guide and should, therefore, not be taken as exhaustive.

Source: starrfm.com.gh

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More