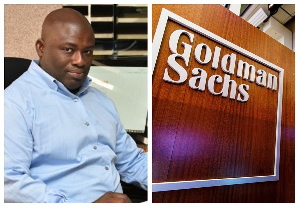

A former Ghanaian banker with Goldman Sachs Group Inc., Asante Berko, has been arrested over his alleged involvement with bribes paid to Ghanaian authorities during his time at the investment bank.

Berko is also the former Managing Director of state-owned enterprise, Tema Oil Refinery.

According to a Bloomberg report, Mr. Berko is facing a six-count charge after his August 2020 indictment documents were unsealed by a federal court in Brooklyn, New York last week.

The charges, per the report, said Asante Berko is accused of conspiring with two Ghanaian authorities and four others in an alleged bribery scheme.

The scheme is said to have favoured Goldman Sachs Group Inc., Asante Berko, and a Turkish-based energy company that was seeking to build a power plant in Ghana.

Bloomberg said the unsealing of Asante Berko’s indictment documents coincided with his arrest last week at London’s Heathrow Airport, where he remains in UK custody.

Further details contained in the indictment sheet said Asante Berko, during the time of the alleged scheme, was serving as a team member at Goldman Sachs where he was responsible for securing, managing, and financing the power plant project in Ghana.

Prosecutors say Mr. Berko allegedly paid a huge sum in bribes in order to obtain the necessary approvals for the Turkish-based power plant company, in which Goldman held a 16 percent stake.

Prosecutors also alleged that the former TOR boss laundered the bribe money through US financial institutions.

In 2020, he was sued over a similar conduct by the Securities and Exchange Commission, where he later in 2021 resolved the suit after he agreed to pay about $329,000 to regulators without admitting or denying the allegations, according to court records sighted by Bloomberg.

The US SEC said Asante Berko, prior to the case, served as vice president of Goldman’s Natural-Resources Group and later resigned in 2016.

He later served as Managing Director for the Tema Oil Refinery and also resigned from the position after the US SEC filed a suit against him.

Meanwhile, Asante Berko is said to have been involved in another foreign-bribery case which saw his former company, Goldman Sachs, pay more than $2.3 billion for its involvement in looting from a Malaysia-based sovereign wealth fund.

A lawyer representing Asante Berko, Carl Loewenson, a spokesman for Brooklyn US Attorney, Breon Peace and a spokesperson for Goldman Sachs all declined to comment on the matter at the time the report was filed by Bloomberg on November 9, 2022.

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More