After nearly two decades of a cosy relationship between the central leadership of organized labour and government, a deep dispute is brewing following the announcement of a plethora of new taxes in the 2021 budget proposals and a subsequent warning from the Ministry of Finance that the resultant erosion of public sector workers’ purchasing power will not be ameliorated by any significant wage increases over the next three years.

Following the inevitable disgruntlement by organized labour about the effects of the new tax proposals contained in the 2021 budget and accompanying early calls for public sector wage increases to compensate for the effects on workers household budgets, Dr Samuel Nii Noi Ashong, Technical Advisor to the MoF declared at a public function last week that government will not provide significant increases to the public wage bill until 2024 because government can simply not afford them.

Unsurprisingly, both the leadership of the Trade Unions Congress and some industry-specific labour chieftains have rejected government’s stance outright. While they acknowledge government’s fiscal difficulties they point out that the new taxes will create equally intense financial difficulties for public sector workers; and unlike government which has policy options, those workers have no other recourse.

The government plans to increase the VAT flat rate and NHIL by one percentage point which will mean an increase in the VAT flat rate from the current 3 percent to 4 percent while that of the NHIL will increase from 2.5 percent to 3.5 percent resulting in an increase in retail prices as suppliers pass the increment to consumers.

The government also plans to introduce an Energy Sector Recovery Levy of 20 pesewas per litre as well as a Sanitation and Pollution Levy of 10 pesewas per litre on petrol and diesel.

Given current world crude oil prices, the implementation of the proposed levies will result in a 5.7 percent increase in petroleum prices at the pump which will inevitably reverberate across the economy in the form of higher product prices in general.

Added to all this, though the budget statement did not indicate any revised figures, government has announced that it intends to increase road tolls too, which will further increase transport costs and resultantly, inflation.

But government now claims that it is not in a financial position to raise the wages of its workers to compensate for impending higher price levels across the economy, until 2024.

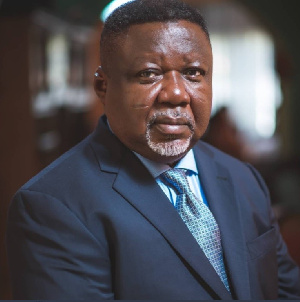

The Technical Adviser at the Ministry of Finance, Dr Samuel Nii Noi Ashong disclosed this while contributing to a discussion on the budget organized by the Ghana National Chamber of Commerce and Industry (GNCCI), last week

“If you look at the Budget, Covid-19 is not expected to abate until the end of 2023 and we’re all looking to be tightening our belts for a while and people should not be expecting huge wage increases in the course of the next few years. This is because we don’t have money to pay for it” he warned.

“ If you net up all the mandated transfers which are required by law, talk of GETFund transfers, National Health Insurance, District Assemblies Common Fund (DACF), the rest which is left is not enough to pay for wages and salaries, goods and service, and social intervention programmes, is not enough to pay for even wages and salaries,” he said.

He explained that if government is using that to pay for goods and services and other costs it “will be left with 40% in the hole and government would have to go and borrow to pay for that extra 40% plus goods and services and other commitments.”

Dr Nii Noi Ashong said, “it is not a rosy picture and let’s call a spade a spade – the reality is that we don’t have the money” he insisted last week

But organized labour disagrees on two levels. One is that government alone cannot decide the wage levels of its workers unilaterally since there is a legal framework for negotiating wages. The other is that government can afford wage increases if it really wants to by changing the way it administers its tax regime.

Points out Mrs Naa Ayeley Ardayfio, the TUC’s Public Relations Officer, the power to decide on the wages of public workers, be it an increase or decrease, does not lie in the hands of the government alone, insisting that it is the job of the Standing Joint Negotiation Committee to decide on the wages of personnel in the public sector and not the government.

But organized labour chieftains are even more adamant over the fairness of government’s stance.

The President of the Graduate Teachers Association of Ghana (NAGRAT), Angel Carbonu opines that it is unacceptable for the government to take such a decision especially when it has introduced new levies and taxes.

“That is highly unacceptable. Unacceptable for the government to say for the next three years we should not expect anything appreciable. Are all economic factors being held constant?

“Are the prices of goods and services being held constant? Are we not part of society when it comes to increasing fuel cost which leads to increase in transportation, accommodation and so on and so forth?” he queries.

Labour chieftains point to the fiscal measures being proposed by government to alleviate the effects of the imposition of new taxes on businesses.

For instance, the budget proposals include a tax rebate of 30 per cent on the income tax due for companies in hotels and restaurants, education, arts and entertainment, and travel and tours for the second, third and fourth quarters of 2021.

For operators of small businesses using the income tax stamp system, government is suspending the quarterly income tax instalment payments for the second, third and fourth quarters of 2021.

There is also an extension of the waiver of interest as an incentive for early payment of accumulated tax arrears.

Labour leaders are querying why public sector workers are not also getting such targeted relief through fiscal measures, even as they are to be denied straight forward wage increases either.

In response to government’s argument that it cannot afford to do better the TUC points towards what it regards as failures with regards to both the tax framework and how it is being administered.

The TUC asserts that given the massive loss of employment and incomes, an untargeted consumption tax approach to recovery is economically risky. It points out that existing – but un-implemented – taxes aimed at the wealthier segments of the populace can provide the revenues government needs without further burdening households that are already in dire straits because of the economic impacts of COVID 19.

It points out that “property tax can be another important source of government revenue if its collection can be properly coordinated by central government, but it appears that the District/Municipal/Metropolitan Assemblies have neither the capacity nor the incentives to collect property taxes.”

The Ghana Trades Union Congress also wants government to re-examine the tax exemptions captured in the 2021 Budget and also abolish taxes that have outlived their usefulness.

“There must be a comprehensive review of benchmark values used to calculate import tariffs, fees and levies at the ports. An increase in the benchmark values for all products that have local substitutes will raise revenue and support the import-substitution agenda under the Ghana-CARES programme”, it asserts in its assessment of the new budget.

To be fair to government it is looking to rope the vast informal sector into its income tax network as a permanent solution to its revenue shortfalls, but between now and when it is able to fully implement the new tax administration framework that will enable this it increasingly looks as if it will have to go head to head with its workers.

Source: Goldstreet Business

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More