The government has launched a GH¢2 billion guarantee scheme to support universal banks in the country to offer financial support to small and medium enterprises (SMEs) for them to recover from the COVID-19 shocks.

The Ghana Care Guarantee Scheme (GCGS), to be administered by the Ghana Incentive-based Risk-sharing System for Agricultural Lending (GIRSAL), is to help SMEs to borrow from banks at lower rates and with longer tenor.

The GIRSAL is a non-bank financial institution incorporated as a private company by the Ministry of Finance, with seed funding from the Bank of Ghana (BoG) and the African Development Bank (AfDB).

The GCGS will guarantee up to 80 per cent of the credit extended by participating banks to their clients.

Targets

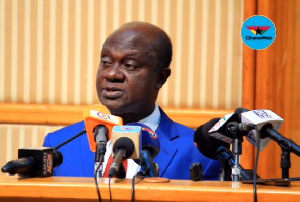

Launching the initiative in Accra, the Minister of Planning, Professor George Yaw Gyan-Baffour, explained that under the initiative, the government had targeted specific industries within the agri-business, manufacturing, hospitality and tourism and technology sectors, among others.

The minister, who performed the launch on behalf of the Minister of Finance, Mr Ken Ofori-Atta, said the government was doing that, among a number of things, for the private sector because it was aware of the impact of the COVID-19 on their businesses.

In attendance were captains of industry and chief executives of various universal banks in the country.

Prof. Gyan-Baffour added that the government was also doing that with the knowledge that the SMEs were the backbone of the economy, since they represented about 85 per cent of businesses and contributed about 70 per cent to Ghana’s Gross Domestic Product (GDP).

Employment

He noted that enterprise accounted for an overwhelming proportion of employment in the country, and that was the reason the government had set aside that amount to help SMEs undertake the necessary adjustments to survive the impact of the pandemic.

Source: GNA

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More