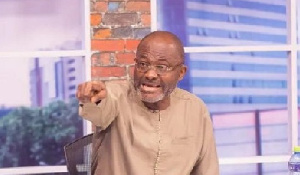

Assin Central Member of Parliament, Kennedy Agyapong has revealed that despite being in charge of several businesses, he does not take bank loans.

According to him, the sole reason for that posture is because of the ridiculous nature of interest rates charged by the banks.

Addressing students of the University of Professional Studies – Accra, UPSA, during a public lecture last Thursday, Agyapong lamented how other foreign nationals take loans from their countries to come and invest and make profits here in Ghana.

He shared with the gathering how he manages to keep out the temptation of approaching banks stressing the importance of savings and building of capital for all persons seeking to flourish in business.

“I don’t take loans from banks because the interest rates are ridiculous. The day that you will hear that banks are coming to take my property, that day when I enter my room, I know I will die and I won’t come back again.

“Yes, because I don’t believe in banks. If I start a project and I hit a wall, I will go back and regroup myself. No amount of temptation will let me go for 26%, hell no. It won’t work. So if you are here and you and you want to do business, start saving today,” he advised.

About Ghana’s interest rate

As recently as late February 2022, the research arm of rating agency, Fitch Solutions projected that Ghana’s central bank will significantly increase its monetary policy rate should upside risks to the economy continue throughout this year.

According to the agency’s February 2022 West Africa Monitor Report, it explained that risks to the outlook are heading towards a high-interest rate increase despite the Bank of Ghana’s current forecast.

It further said inflationary pressures due to increasing government expenditure and constraints in global supply chains will place more pressure on the Bank of Ghana.

Meanwhile, the Bank of Ghana has maintained its monetary policy rate at 14.5 percent after its first meeting of January 2022.

The policy rate is of keen interest to businesses and the private sector as it determines the rate at which the Central Bank will lend to commercial banks. It also subsequently influences average lending rates on loans to individuals and businesses.

Source: www.ghanaweb.com

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More