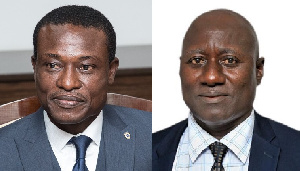

Kissi Agyebeng, the Special Prosecutor has announced that his office has started a wider probe into the activities of the Customs Division of the Ghana Revenue Authority (GRA).

In a press release dated August 15 and signed by Agyebeng, he said the need for a wider probe was premised on the findings of his office in respect of a complaint against Labianca Company Limited and the Customs Division of the GRA in an August 3 report.

That report elicited some harsh reactions, especially from the head of Customs Colonel (Rtd.) Kwadwo Damoah among others accused the ‘small boy’ Special Prosecutor of seeking to destroy his hard-won reputation.

The SP’s latest release said he had officially written to Damoah demanding records of customs advance ruling and other waivers granted between July 2017 and December 2021.

“On the basis of the report, the Office of the Special Prosecutor has commenced a wider investigation into the issuance of customs advance rulings and markdowns of benchmark values between July 2017 and December 2021.

“On August 11 2022, I directed the Commissioner of the Customs Division to submit to the Office of the Special Prosecutor, on or before 30 September 2022, the particulars of all applications for customs advance ruling, applications for a markdown of benchmark values, application for private rulings and class rulings pertaining to the application of customs law and the decision on each of the applications within the indicated period.”

The release also noted the boss of the GRA has also been asked to submit an integrity plan that will seal all loopholes like the one that the OSP found during their preliminary investigation which birthed the August 3 report.

“On 11 August 2022, I wrote to the Commissioner-General of Ghana Revenue Authority to submit an Integrity Plan designed with the aim of preventing the corruption of the exercise of discretion by officials of the Customs Division, especially in respect of the rendering of rulings, to assure the effective operation of the Customs Act, 2015 (Act 891) and the Revenue Administration Act, 2016 (Act 915), on or before 31 December 2022,” the release concluded.

Source: www.ghanaweb.com

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More