Stocks from three sectors – Mining, Finance and Technology – accounted for 94.5 percent of the market capitalisation of the Ghana Stock Exchange (GSE) at the close of the first half of the year, analysis by the B&FT has shown.

Market capitalisation measures the total cedi market value of outstanding shares and it is calculated by multiplying the total number of a company’s outstanding shares by the current market price of one share; the sum of the market cap of all listed companies is equal to that of the stock exchange.

The Accra bourse closed the period with a capitalisation of GH¢64.84 billion, a marginal 0.54 percent appreciation over its value at the turn of the year and 5.72 percent higher than at the corresponding period last year.

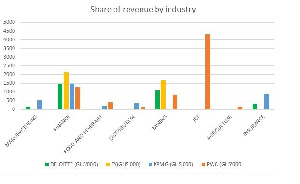

A perusal of the data reveals that mining led, with a market capitalisation of GH¢35.4 billion, or 54.6 percent of the entire market. This was achieved through four stocks, with cumulative outstanding shares of 2.17 billion.

The mining sector – and the wider market – saw GH¢493million shaved off its market capitalisation in January, when Canadian-based, Golden Star Resources exited the market following its sale to Chinese firm, Chifeng Jilong. The sector (and the market) received a boost after another Canadian exploration company, Asante Gold Corporation listed 315 million shares on the main board of the Exchange worth GH¢2.79 billion.

In second and third place were finance and technology with GH¢14.8 billion (22.8 percent) and GH¢11.06 billion (17.06 percent) respectively. The latter is overwhelmingly dominated by telco, MTN, which accounts for 99.99 percent of the market capitalisation of the technology segment. MTN has the second highest number of outstanding shares at 12.3 billion, only Ecobank Transnational Incorporated (ETI) has more with 24.1 billion.

It is not surprising that biggest drivers of the local bourse’s value are all from the main board, as the six companies listed on the Ghana Alternative Market (GAX), valued at GH¢49.8 million – 0.076 percent of the market.

Analysts have said that the composition of the GSE’s market capitalisation by sector is not unusual for an emerging market. They have, however, also pointed out that the market, as it stands, is not reflective of the wider economy.

Additionally, it has been observed the Accra bourse would see a significant jump in its market capitalisation if the price of the financial stocks begins to approach their true value as determined by their price-to-earning (P/E) ratio.

Market cap-to-GDP

Using an average of US$1 = GH¢7.95, the GSE’s market capitalisation at the end of June was US$ 8.15 billion.

Quite tellingly, the market capitalisation is 14.1 percent of the 2021 nominal Gross Domestic Product (GDP) of GH¢459 billion. For context, neigbouring Nigeria has a market cap-to-GDP of 12.6 percent at the end of 2021, albeit with the nominal market capitalisation at US$68 billion at the end of May 2022.

South Africa’s market cap, on the other hand, accounted for 329.3 percent of its nominal GDP in December 2021, compared with 321.3 percent in the previous year.

Speaking during a recent interaction with the media, Managing Director of the GSE, Ekow Afedzie, expressed optimism that steps being taken by the Exchange to improve the market will reflect in the ratio. He disclosed that the Accra bourse has set an ambitious target of raising market cap-to-GDP to 30 percent in the next five years.

Source: thebftonline.com

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More