Following the suspension of a planned demonstration against the implementation of a 15 percent Value Added Tax (VAT) on electricity, Organised Labour has called off its protest against the tax measure of government. Prior to this, various labour unions across the country had planned to proceed with the demonstration even …

Read More »Govt charging VAT on electricity since January 1; finance minister letter shows

A letter from the Ministry of Finance has showed that the government has been changing Value Added Tax (VAT) on a section of electricity consumers in the country. The letter, which was signed by the Minister for Finance, Ken Ofori-Atta, and addressed to the Electricity Company of Ghana (ECG) and …

Read More »Government imposes 21% VAT on Facebook advertisements for business and personal use

The business arm of Facebook parent company, Meta Business, will from August 1, 2023, impose a total of 21 percent in added taxes on personal and business-related advertisements made on the platform. An email from Meta Business said the charge is based on an order given by the Government of …

Read More »Dafeamekpor explains why NDC MP, Theresa Awuni, was absent during the 135-136 VAT vote defeat

The Member of Parliament (MP) for South Dayi, Rockson-Nelson Dafeamekpor, has stated that his colleague MP for Okaikwei North, Theresa Larbi Awuni, is the minority member who was absent during the vote on the 2.5 per cent increase in Value Added Tax (VAT). Parliament on Wednesday, 21 December 2022, approved the 2.5 per cent …

Read More »Parliament passes VAT Amendment Bill increasing VAT rate by 2.5 percent

Parliament has by a majority decision passed the Value Added Tax Amendment bill to increase the rate by 2.5 percent. The controversial bill had to go to a head count for it to pass by 135-136 majority decision. Members of the Minority argued against the upward review of the VAT …

Read More »Cost of medicines to go down after removal of VAT on pharmaceutical products – Govt

The government earlier this week announced the removal of the Value Added Tax (VAT) on pharmaceutical ingredients in Ghana. Similarly, the VAT on selected finished pharmaceutical products have also been removed. This is to ensure that the cost of medicines in Ghana is reduced, the government said. “Government removes VAT …

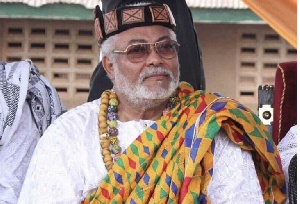

Read More »How VAT was withdrawn from Parliament by President Rawlings

The Nana Addo Dankwa Akufo-Addo led government is hell-bent on passing the Electronic Transaction Levy, E-levy, which is to impose a 1.75% tax on all electronic transactions. Since the announcement of the introduction of the E-levy during the 2022 budget presentation by Ken Ofori-Atta, the finance minister, on November 17, 2021, …

Read More »Tax experts express worry over VAT underperformance

Tax experts have expressed concerns over Value Added Tax (VAT) revenue underperformance, saying government is not reaping the needed and expected benefits due to some challenges associated with the tax regime. With the present VAT regime, which came into force in 2018, companies are no longer charged a standard rate …

Read More » Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More