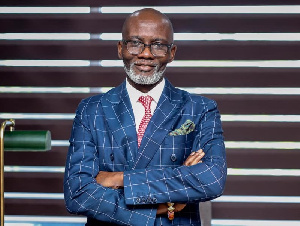

Gabby Asare Otchere-Darko, one of the leading members of the governing New Patriotic Party, NPP, is complaining about how dire the economic crisis has been.

According to him, it does matter where in the world anybody finds himself or herself, the dire economic crisis is very real.

“The hassle is real. Whether global or not, it is real…,” Gabby Otchere-Darko tweeted.

Gabby’s comments come after Ghana’s economy was downgraded to a ‘junk’ status by two international credit ratings.

Standard and Poor’s (S&P) Global Ratings on Friday, August 5, pushed Ghana’s debt further into speculative territory, lowering its foreign and local currency sovereign ratings to CCC+/C from B-/B.

S&P which is one of the ‘Big Three’ credit-rating agencies, including Moody’s Investors Service and Fitch Ratings, in their report stated that the “Covid-19 pandemic and the conflict in Russia have magnified Ghana’s fiscal and external imbalances.”

“There is also demand for foreign currency that has been driven higher by several factors, including nonresident outflows from domestic government bond markets, dividend payments to foreign investors and higher costs for refined petroleum products.

“While these changes could improve the tax take going forward, the situation remains challenging, and over the first half of 2022, the fiscal deficit has exceeded the government’s ambitious target,” S&P Global Ratings stated.

Fitch, on the other hand, has downgraded Ghana’s Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) to ‘CCC’ from ‘B-‘.

In a report on Wednesday, August 10, 2022, Fitch said the downgrade reflects the deterioration has contributed to a “prolonged lack of access to Eurobond markets, in turn leading to a significant decline in external liquidity” and pushing Ghana deeper into junk territory.

“in the absence of new external financing sources, international reserves will fall close to two months of current external payments (debits in the current account) by end of 2022.

“Fitch estimates that Ghana faces USD2.75 billion of external debt servicing in 2022, including amortisation and interest, and USD2.8 billion in 2023. Access to external financing will remain tight, as Ghana is likely to remain locked out of Eurobond markets, which had come to be a regular source of external financing for the government,” the credit rating agency added in its statement.

The Government of Ghana, on July 1, announced a u-turn of an initial decision of not resorting to the IMF for support despite economic hardship hitting the citizenry.

Consequently, a team from the IMF arrived in Ghana to start negotiations with the Ghana government. The government has since maintained to secure a good deal for the country.

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More