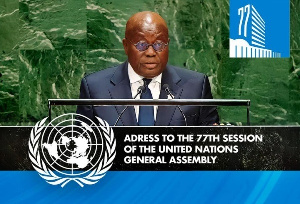

President Nana Addo Dankwa Akufo-Addo has reiterated the impact of the Russia-Ukraine war on the global economy,, more especially on African countries.

The president holds that the war which started in February 2022 aggravated an already precarious situation for African economies that were starting to recover from the effects of the COVID-19 pandemic.

Akufo-Addo said the war had direct impact on Africa especially in the area of food supply triggering importantly, inflation.

“Two years ago, our world came to a thundering halt, as we cowered from a health pandemic from an unknown, malicious virus, coupled with a devastating global economic pandemic. High budget deficits were no longer concerns of only developing nations.

“By 2021, COVID-19 had pushed Africa into the worst recession for half a century. A slump in productivity and revenues, increased pressures on spending and spiralling public debts confronted us without relent,” he submitted.

On the specific case of the Russian invasion, even though Moscow insists it was a military operation, Akufo-Addo stated: “As we grappled with these economic challenges, Russia’s invasion of Ukraine burst upon us, aggravating an already difficult situation.

“It is not just the dismay that we feel at seeing such deliberate devastation of cities and towns in Europe in the year 2022, we are feeling this war directly in our lives in Africa.

“Every bullet, every bomb, every shell that hits a target in Ukraine, hits our pockets and our economies in Africa. The economic turmoil is global with inflation as the number one enemy this year,” he added.

Government has routinely explained that recent economic headwinds are attributable largely to the ravages of the COVID-19 pandemic, the ongoing Russia-Ukraine war and the banking sector clean-up.

The rippling effect has been an increase in the cost of living, record high inflation rates and downgrades of the economy by rating agencies such as S&P and Fitch – a situation which has dealt a heavy blow to government’s ability to access the international capital market.

The Cedi has also been on a free fall compelling the Bank of Ghana to resort to hiking its monetary policy rate to deal with the situation.

The worsening economic situation compelled the government in July to initiate contact with International Monetary Fund for an economic support programme.

Ghana is targeting an amount of US$3 billion over three years from the Fund once an agreement on a programme is reached.

Government hopes to complete negotiations by end of the year in order to receive the funds in the first quarter of next year.

SARA

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More