Despite the daunting challenges in the financial sector in 2018, Bonzali Rural Bank Limited (BRB) managed to carry out its strategies extremely well to uphold its financial performance and stay afloat.

As at 31st December 2018, the bank recorded a total deposit of GH26,138,762.00 as against a figure of GH26,001,724.00 in 2017 representing 0.53 per cent while the cumulative basis of the bank’s profit before tax grew by 10.54 percent by the end of 2018.

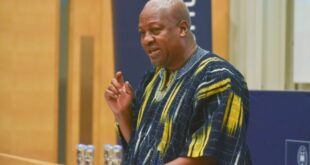

The Board Chairman of the Bank, Chief Mahama Andani announced this at the 11th Annual General Meeting (AGM) of the bank held at its headquarters at Kumbungu in the Northern region.

Profitability on a comparative basis, however, witnessed a significant decline over the corresponding year of 2017 as a profit of GH78, 889. 00 compared with GH 748, 680 representing a negative growth of 89.46 per cent of the year he said.

He added that the total income recorded for 2018 was GH 9, 988, 194.00 representing marginal decline of 9.46 percent over the 2017 figure of GH 11, 032.00.

The total loan and advances portfolio stood at 15,204,386.00 in 2018 compared with GH 13,841, 284.00 representing growth over the previous year whilst net loans grew by 7.78 percent in 2018.

Total asset of the bank stood at GH 37, 360, 174 in 2018 compared with the corresponding year figure of 38,126,029.00 in 2017 representing a decrease of 2, 01 percent and increase of 22.65 percent in 2017.

He said the shortfall of the bank was driven by the banks non-performing investment with other financial institutions and general decline in interest rates on investment among other variables.

“It is however important to state that liquidity which is the life blood of any financial institution was stable throughout the year 2018 as the bank was able to adequately meet its customers demand and other short term obligations as and when due” he said.

Chief Andani noted that the bank was able to improve the quality of its products and services such as microfinance loan weekly, bi-weekly repayment and six month repayment duration.

He stressed that the bank has secured an amount of four million Euro and 500,000 USD from SNV and UNICEF respectively to provide water, sanitation and hygiene (WASH) projects in the Northern region.

He said the bank was committed to partner with government to mobilize the people and offer the necessary support through funding for projects towards its development agenda for the Northern Region.

“In the year 2017 and 2018, as part of our corporate social responsibility we spent a total of GH81,988.00 and made donations to individuals and institutions in the area of health, education, and sports” he said.

The District Chief Executive for Kumbungu District Mr Abdul-Salam Hamza Fataw reiterated government’s commitment to partner rural banks to implement some of its policies to reduce poverty in the rural areas.

He admonished financial institutions to study the financial sector and take advantage of emerging opportunities to expand and better their services to increase profitability.

“The Banking sector needed to be creative, proactive, sensitive and always put customers first as they are the reason for which the banks were established and in operation” he said.

The General Manager of the Bank Mr Paul Atsu Fiawoo said, the bank has the capacity to support farmers this year with funds and fertilizer subsidy for their crop production to ensure maximum yields to improve food security.

He said the bank was implementing the government initiative of the Planting for Food and Jobs across its catchment areas by supporting the farmers with the needed farm inputs.

The manger said the bank is projecting to maintain its dominance in microfinance operations in 2019 and beyond and that the bank in its corporate strategic planning between now and 2021 envisaged to extend its operations to Saboba, Bimbilla, Aboabo market and Kukuo in Tamale.

“There are plans to issues 200,000 ordinary shares to both existing and potential shareholders for sustainability and growth of the bank’ he said.

Source: thebftonline.com

Home Of Ghana News Ghana News, Entertainment And More

Home Of Ghana News Ghana News, Entertainment And More